Russia Ukraine and Mortgage Rates

As if the Federal Reserve wasn’t juggling enough factors these days, the Russia Ukraine situation could muddy up those waters even more. There has been much speculation about the Federal Reserve increasing their short-term interest rate in March 2022 and numerous times throughout this year. All the economic variables that would cause them to come to such a conclusion are still in place; however, the recent complications between Russia and Ukraine mean that they may have to take into consideration additional factors that were not on the table just a short few weeks ago.

As a quick reminder, the Fed’s primary policy motives are to make sure prices, via inflation control, are held in check, while also helping foster labor market growth in the overall economy. Both of these motives have come under immense pressure over the last year and a half. Sentiment leading up to March 2022 has been that they will increase the Fed Funds Rate between 0.25% – 0.50% with zero economists polled answering “no change”. What this means is there is definitely going to be a rate hike of their short term interest rate, but with the emergence of the Russia Ukraine situation the sentiment has begun to change. Just a few days ago it was widely believed that the 0.50% interest rate increase was all but certain; however, uncertainty abroad and its impact on our energy markets could put the Fed at a greater imposition than they were already in. If they are only able to raise their short-term rate by 0.25% we are likely to see mortgage rates go even higher, and inflation continue for more months than anticipated. If you missed the last Producer Price Index (PPI) reading of +9.7% we are already staring down of the barrel of additional inflation pressure making its way onto consumer shelves over the next 3-6 months. The conclusion: affordability across the board is at risk for our overall economy. It should also be noted that monetary policy does not directly change certain pressure points like supply chain issues. While Monetary policy may impact the prices we experience on the shelf, it does not make ships go faster or products arrive sooner.

So what does this have to do with interest rates?

Historically, during geopolitical unrest, our bond market benefits greatly from financial institutions, investors, and governments at large seeking “safe havens” for their money. That safe haven for many has been the US dollar and Treasury bonds (to name the most common). This directly impacts mortgage rates and typically causes them to decline. Think of this in terms of the law of supply and demand: Where there is a lot of money to go around it is typically less expensive to borrow, and when there is scarcity of money it becomes more expensive to borrow.

Should we expect rates to go down then?

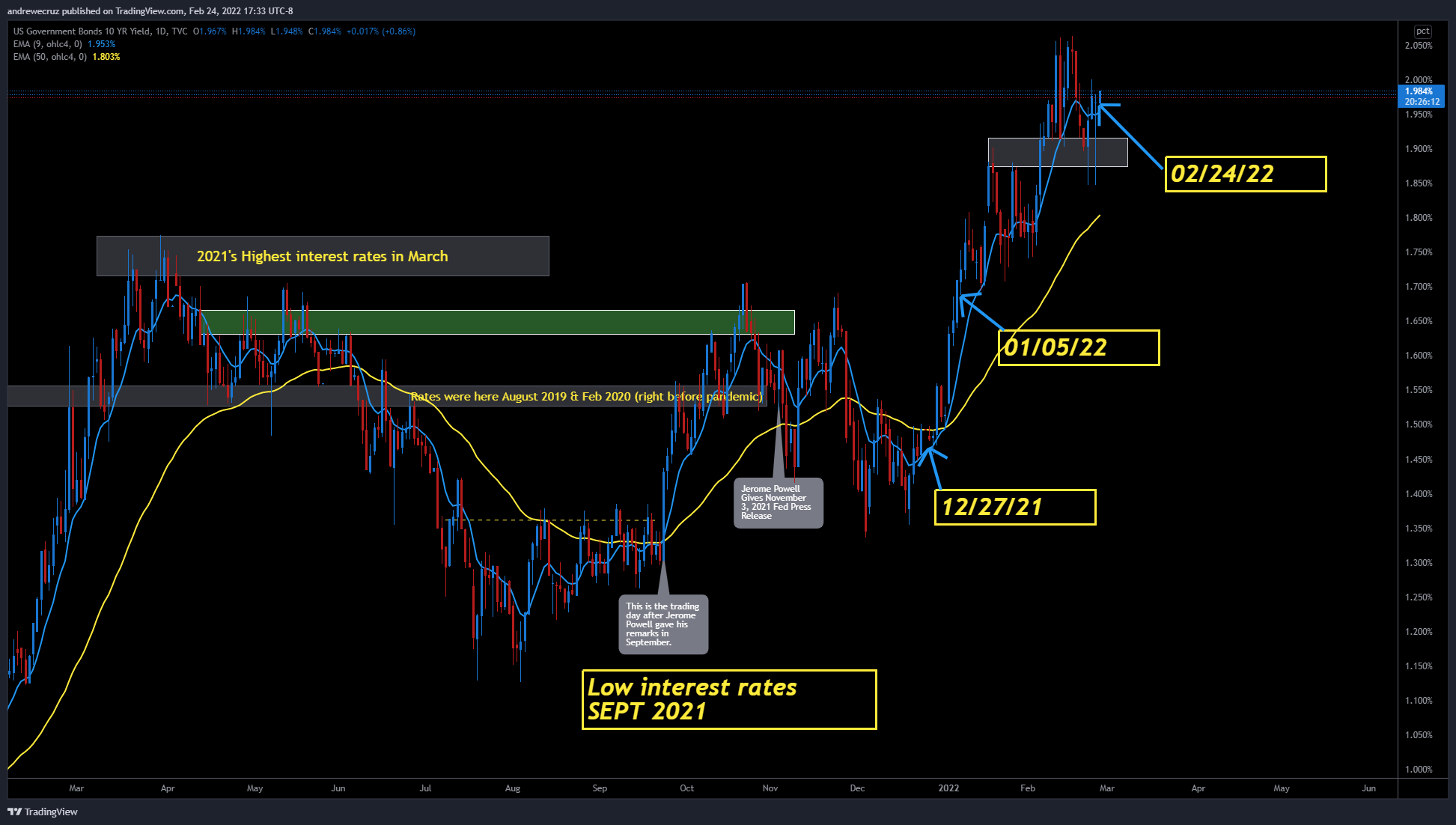

It is too soon to tell. Due to the mechanics and fundamentals underneath the overall global economy already under great pressure, the addition of the Russia Ukraine conflict just complicates it even more. We monitor the 10-year treasury yield as a barometer for the overall sentiment and direction of bond pricing. As you can see in the graphic below, 10 year yields have been increasing for several months leading up to what is believed to be the federal reserve’s interest rate hikes beginning in March. Additionally, the Federal Reserve is going to begin removing themselves from the bond buying program that has kept the housing and real estate market charging over the course of the pandemic. Both functions are predicted to cause rates to increase. Evidence of the sentiment about that outcome are reflected in the bars inclining since December 2021. Mortgage Rates have followed suit, increasing at the same rate for the same duration of time marked out in the chart.

If rates are to come back down from where we are at now, then it may fall down to the area we saw back at January 5th 2022. That is the most likely area for the bond pricing to return to first; however, the chances of that have narrowed because of the Russia Ukraine conflict.

If rates are to go up then they will go up as a direct response to the Federal Reserve’s March meeting and new comments revealing their sentiment. That will give us insight on their confidence about their control over monetary policy now considering this most recent geopolitical unrest.

CONTACT US DIRECTLY

If you would like to speak with our team about your home loan questions, please complete the form below. You can also start your loan application online by APPLYING NOW.

Rates & Fees Disclosure:

‡ The payment on a $300,000 30-year fixed-rate VA loan at 3.000% with a 80% loan-to-value ratio is $1,292.01 with 0 (zero) origination points due at closing. The annual percentage rate (APR) is 3.235%. Payment does not include tax and insurance premium impounds. The actual payment amount will be greater. By refinancing your existing loan, the total finance charges may be higher over the life of the loan. Some state and county maximum loan amount restrictions may apply. Appraisal fee of $600, Processing Fee of $895, Underwriting Fee of $795 included in APR calculations with borrower paying 0 (zero) loan origination points.

‡ Based on Mortgage Heroes internal data.

Follow us on Facebook

WE GOT YOUR SIX!

Mortgage Heroes has been helping Active Military and Veterans for more than 15+ years. This page is made to help all military families get the answers they are looking for when it comes to housing. Whether its questions about using your VA or new listings in SD, Mortgage Heroes are here to support just as each military member has supported this country!

GET IN TOUCH

Mortgage Heroes

873 Anchorage Place

Chula Vista, California 91914

group@yourmortgageheroes.com

(619) 934-7775

NMLS# 325149

See NMLS consumer access page