2022 Conforming Loan Limits Confirmed for San Diego

Buying or refinancing a home in 2022 just got a bit easier!

Buying or refinancing a home in 2022 just got a bit easier! Yes, despite home price appreciation being at all time highs and loan rates hovering about historic lows, we have more silver lining headed our way. On Tuesday November 30, 2021 the Federal Housing Finance Agency (FHFA) announced their new conforming loan limits for 2022 and they are very close to what we projected just a few weeks ago. Beginning January 1, 2022 the conforming loan limit for one-unit properties will be $647,200, an increase of $98,950 from $548,250 in 2021.

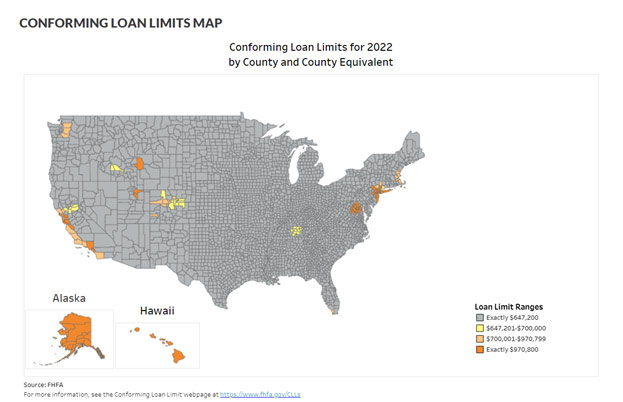

Each year the Housing and Economic Recovery Act (HERA) requires that the baseline conforming loan limit be adjusted to reflect the change in average home price. As a result of average home values increasing over the last 4 quarters by 18.05% the result is an 18% increase in loan limits. Further, for high-cost areas of the country where 115 percent of the local median home value exceeds the baseline conforming loan limit, the applicable limit will be higher than the new baseline (see map below). This is great news for San Diego County, Orange County, Los Angeles Country just to name a few. As you can see these high-cost areas meet that qualification for even higher loan amounts for home purchase as well as rate & term refinance and cash out refinance.

And this is where the great news really kick in for those of you in Southern California. As you know a conventional loan is any mortgage loan that’s not backed by a government agency (non VA, non FHA, non USDA). Conforming loans are the only mortgage type which can be backed by Fannie Mae and Freddie Mac. High Balance Loans (commonly called “Jumbo loans”) are defined by their loan amounts which exceed the conforming limit. Since we will now operate under the new conforming loan limits the definition of “Jumbo Loan” will be even higher than it has been in years past. Add to this, Jumbo Loans tend to carry higher interest rates and more stringent guidelines, this increase in the conforming loan limits just eased the pressure on tens of thousands of homeowners seeking to better their personal financial outlook.

You may recall that a few banks began accepting loans up to these upcoming limits well beforehand to get a jump on their competition. All evidence suggests that this was a bold, but correct move to help homeowners purchase their first home during the final few weeks of 2021. And the news was even better for homeowners who sought a rate & term refinance or cash out refinance in San Diego, as some banks opened up their 2022 conforming limit pricing which saved thousands of dollars in long term interest in addition to reduced monthly payments.

Below are a few suggestions for aspiring homeowners in San Diego who are not yet approved under the new confirming loan limits, but are still searching to purchase their dream home:

- Find your local mortgage expert and get your purchase loan approval updated.

- If you are shopping for homes I two counties which happen to have neighboring county lines, they may have different conforming loan limits. Plan accordingly and be aware that the corresponding county may have a lower or higher limit than the county next door.

- Confirm that your real estate agent and local mortgage expert are on the same page regarding your approval limits and purchase capability.

- Revisit your personal monthly budget to measure the impact of these new loan limits on your affordability. You may be able to afford more home now that you can get a conforming loan rate vs. a Jumbo loan rate.

- Get out there and kick that house hunt into high gear.

Below are a few suggestions for San Diego homeowners who are looking for a rate & term refinance or cash out refinance with the new 2022 conforming loan limits:

- Ensure you have made at least 6 payments on your current loan before you attempt to refinance into a new loan in 2022. (If you refinanced between June 2021 – December 2021, you should make at least 6 monthly payments before you attempt a new refinance).

- Determine if need a rate & term refinance or a cash out refinance. If you do not know, please ask your local loan expert who can help you understand the difference and make the best choice.

- Meet with a local mortgage expert who can talk through your options, discuss rate pricing, and desired outcomes with you.

- Measure your personal monthly mortgage savings and/or your total out of pocket savings if you are paying off debts via a cash out refinance.

The outlook for 2022 is still very positive for real estate and mortgage. With projected home prices still expected to appreciate and the conforming loan limits being raised to meet the price range of large swaths of the entire country, we are likely to see a very healthy purchase market in San Diego and throughout Southern California. If you would like to discuss the direct impact of the 2022 conforming loan limits will have on your homeownership, one of our mortgage experts will be happy to guide you.

CONTACT US DIRECTLY

If you would like to speak with our team about your home loan questions, please complete the form below. You can also start your loan application online by APPLYING NOW.

Rates & Fees Disclosure:

‡ The payment on a $300,000 30-year fixed-rate VA loan at 3.000% with a 80% loan-to-value ratio is $1,292.01 with 0 (zero) origination points due at closing. The annual percentage rate (APR) is 3.235%. Payment does not include tax and insurance premium impounds. The actual payment amount will be greater. By refinancing your existing loan, the total finance charges may be higher over the life of the loan. Some state and county maximum loan amount restrictions may apply. Appraisal fee of $600, Processing Fee of $895, Underwriting Fee of $795 included in APR calculations with borrower paying 0 (zero) loan origination points.

‡ Based on Mortgage Heroes internal data.

Follow us on Facebook

WE GOT YOUR SIX!

Mortgage Heroes has been helping Active Military and Veterans for more than 15+ years. This page is made to help all military families get the answers they are looking for when it comes to housing. Whether its questions about using your VA or new listings in SD, Mortgage Heroes are here to support just as each military member has supported this country!

GET IN TOUCH

Mortgage Heroes

873 Anchorage Place

Chula Vista, California 91914

group@yourmortgageheroes.com

(619) 934-7775

NMLS# 325149

See NMLS consumer access page